EU Taxonomy compliant real estate

Significance and requirements of the EU Taxonomy regulation in the real estate industry

Why it is important

The creation of climate-resilient and sustainable real estate is becoming increasingly important due to the already noticeable consequences of climate change, such as heat waves and heavy rainfall events and the resulting ecologization of capital flows on the basis of the EU Taxonomy Regulation.

Background information

End of 2021 the EU Taxonomy Regulation came into force as a cornerstone of the “European Green Deal”. The building sector was defined as one of nine economic sectors with corresponding taxonomy criteria. Since the beginning of 2022, real estate is assessed based on specific sustainability criteria. With this measures the EU wants to ensure that capital flows increasingly into sustainable investments. The intention is to advance a transition to a low-carbon, more resource-efficient and sustainable economy and put an end to greenwashing.

Defined criteria and risks for six environmental goals determine if a real estate is “green” or not. These 6 environmental objectives are:

- #1 climate change mitigation

- #2 climate change adaptation

- #3 sustainable and protection of water and marine resources

- #4 transition to a circular economy

- #5 pollution prevention and control

- #6 protection and restoration of biodiversity and ecosystems

Every project has to deliver a substantial contribution in one environmental goal while doing no significant harm to the other environmental goals. To be considered sustainable, an investment must finance climate change mitigation and adaptation because those are the two environmental objectives of the EU Taxonomy, which determines whether an economic activity in the real estate sector is sustainable.

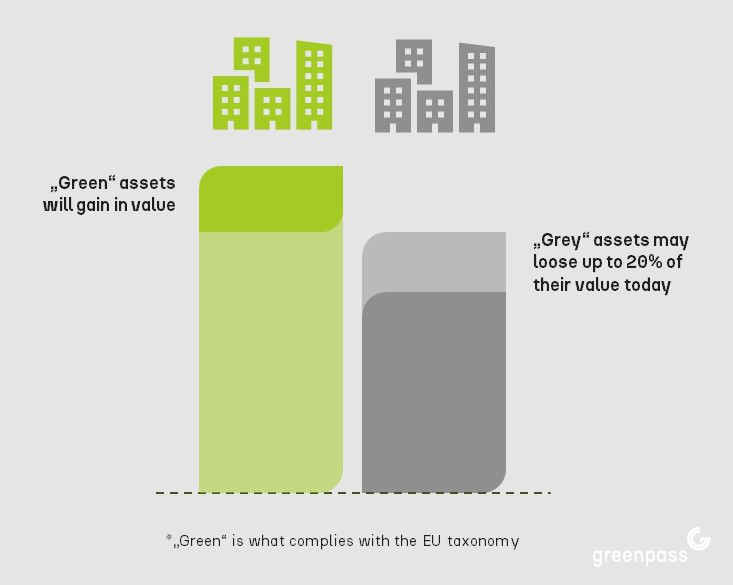

Effects

With the enactment of the EU Taxonomy, sustainability has become a crucial aspect that has a direct impact on real estate and investments. This has resulted in better financing conditions for future-proof and climate-resilient real estate and investments. The EU Taxonomy Regulation applies for all economic activities:

Challenges

There is still a lack of clarity within the industry regarding the application of the taxonomy. According to different industry surveys, a lot of real estate companies lack precise knowledge of which criteria a property must meet in order to be considered taxonomy-compliant and there are complains about a lack of detailed guidance on how to enforce ESG criteria.

Solution

Greenpass has developed a reliable method to verify the conformity of building projects with the requirements of the EU Taxonomy regarding environmental objective #2 – climate-change adaptation. The greenpass EU Taxonomy Module includes analysis, assessment, optimization and an official quality certificate for climate-resilient and sustainable real estate based on quantitative scientific data.

For a holistic compliance with the EU Taxonomy greenpass cooperates with different auditors, such as the blue auditor. Blue auditor is a digital platform that assesses the sustainability of real estate portfolios according to internationally recognized standards as well as other sustainability KPIs. In cooperation with the Austrian Sustainability Council ÖGNI EU Taxonomy Advisors (approved by ÖGNI) can use the blue auditor platform for EU-Taxonomy assessments to support the mandatory reporting requirements.

Methodology

The identification of climate risks for the project site is done with the use of risk databases and relevant risks get classified as low, medium or high. The project is analyzed via a digital twin created with the greenpass Editor v2.0 and high resolution 3D simulation using ENVImet for climate scenarios based on EU Copernicus climate datasets.

Measures are proposed for the climate hazards that effect a location in order to mitigate their potentially negative consequences on the economic attractiveness of new and existing buildings. They are presented in terms of their effectiveness of cost efficiency in relation to the risks.

The climate resilience of a project is assessed by calculation of climate indicators in regard to heat stress, the heat island effect and thermal storage capacity. This way, the necessity of climate change adaptation measures becomes apparent and the effectiveness of the already implemented measures on the energy balance and above all, the thermal comfort and health of people can be evaluated. More detailed information can be found in the greenpass product book for the EU Taxonomy Module.

Best-practice example

The Square One is a multifunctional office building in the up-and-coming Muthgasse/Heiligenstadt urban development area in Vienna and one of the first EU taxonomy-compliant buildings in Vienna. A number of effective measures to mitigate and adapt to climate change and the associated risks have been successfully implemented. The DGNB platinum-certified property was comprehensively checked for all environmental goals of the EU taxonomy in cooperation with the Austrian Sustainable Building Council (ÖGNI), PricewaterhouseCoopers (PwC) and greenpass. The certification confirms the pioneering role of one of the most modern office buildings with future-proofness and high investment security.

Square 1 Vienna

EU Taxonomy conform real estate

Building with approx. 0,7 ha

Customer: ÖGNI \ Strabag Real Estate

Completion: 2017

Architecture: HNP Architects

EU Taxonomy: ÖGNI, PwC, greenpass

“The Square One shows how sustainability can be reconciled with the requirements of the EU Taxonomy. Together with PwC and greenpass, we were able to successfully confirm the building’s conformity with the requirements of the EU Taxonomy.”

Peter Engert

CEO ÖGNI